SHIFT ALERT: The 🇬🇧 UK has leap-frogged 🇨🇳 China to become the #2 largest foreign holder of US Treasuries.

But what’s really happening?

The Bank of England isn't on a buying binge. Rather it's global banks, insurers, custodians and hedge-fund “basis traders” booking positions through the City.

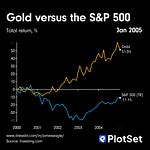

China’s been drip-selling Treasuries for a decade, rotating into agencies, gold and crucially, shorter-dated bills to keep its options open.

Some PRC cash is simply moving “off-camera” via Euroclear/Clearstream, making the UK’s ledger look fatter.

Why it matters:

1️⃣ The foreign share of the $27 trillion US Treasury market keeps shrinking, raising Washington’s sensitivity to ratings downgrades and home-grown demand shocks.

2️⃣ A thinner Chinese bid can nudge yields higher just as the Fed flirts with cuts.

3️⃣ For the City, it’s a post-Brexit branding win: London remains the balance sheet for global dollar flow.

What to watch next:

May TIC data... does the gap widen?

Leverage in UK “basis trades” after 2022’s LDI scare.

China’s record gold imports.

👇 Your thoughts?

Music: Slushy by Cushy-2, Epidemic Sounds

#BondMarket #Macro #Investing #London #China #USTreasuries

Share this post