I’ll admit my bias upfront: I deeply oppose tariffs because they contradict everything I believe about free trade. Trade is the thread that stitches our world together, compelling us to engage with one another whether we like it or not.

There’s a paradox in that old Latin adage, radix malorum est cupiditas (”greed is the root of all evil”). While greed may drive many evils, money itself has become humanity’s universal language of trust. We accept currency even from our adversaries, and this shared medium of exchange binds us together in ways that transcend politics and conflict.

This economic interdependence gives nations compelling reasons to preserve peace. When prosperity depends on trade, war becomes not just morally unconscionable but economically irrational. Every tariff erected weakens this fabric of mutual dependence.

Of course, this only works when trade is reasonably fair. When nations exploit the system through predatory subsidies or intellectual property theft, they undermine the very trust that makes peaceful commerce possible. Tariffs become tempting tools to level the playing field.

I believe commerce remains one of humanity’s greatest forces for peace. While tariffs don’t end trade, they do risk weakening those bonds that discourage conflict. Each new trade barrier, however justified, makes cooperation that bit harder and confrontation that bit easier.

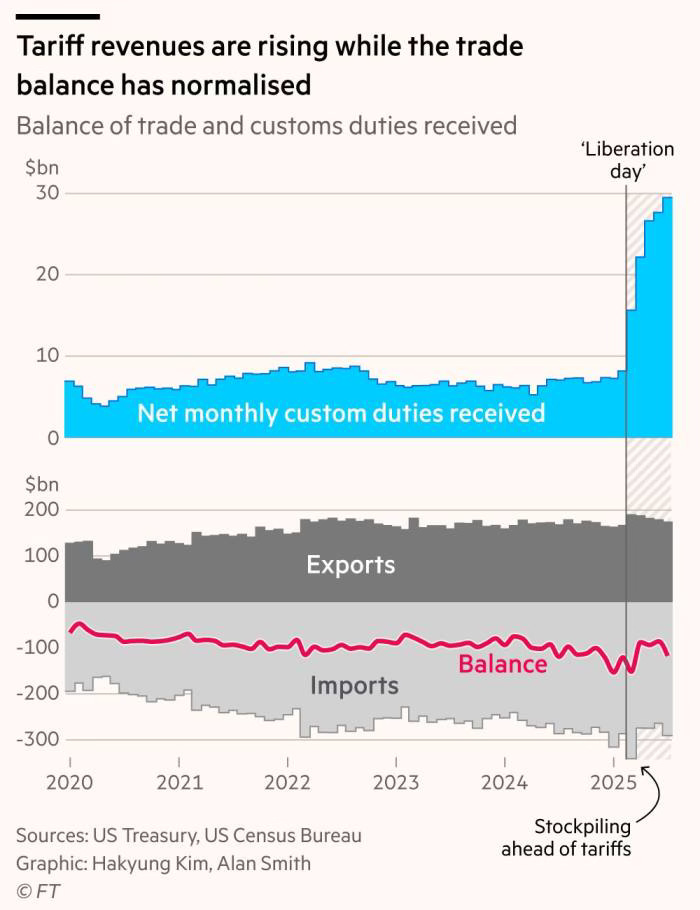

CHART 1 • Tariff receipts have exploded

Here’s the dirty secret about tariffs: they’re a magnificent tax machine. Monthly customs receipts have rocketed from $7-8 billion to nearly $30 billion, while the trade deficit yawns at the same old $90-110 billion, utterly unmoved by the current protectionist theatre.

American businesses and shoppers meanwhile foot most of the bill through higher prices. Clever multinationals meanwhile, simply shift their supply chains, shipping through Vietnam or Mexico rather than bringing jobs home. It’s taxation dressed up as trade policy.

For investors, this is perverse: retailers and car manufacturers are bleeding margins while government coffers swell. The speed of it all is breathtaking. Tariff receipts nearly quadrupled overnight, yet the trade deficit couldn’t care less. Anyone betting this windfall will last is dreaming. It’s a transfer of wealth from the private sector to the public sector. This is cyclical cash grab, not structural reform, and the hangover will be spectacular.

Source: Unhedged Newsletter, Financial Times

I’ve tried to stay balanced about tariffs, but it’s hard because they offend everything I believe about trade. Still, numbers don’t lie: tariff revenue has exploded. The problem is that even these eye-watering sums are pocket change compared to America’s $1.2 trillion annual interest bill.

I’ve got four more charts that show exactly how this plays out. But you’ll need to be a paid subscriber to see them.

Keep reading with a 7-day free trial

Subscribe to Killer Charts to keep reading this post and get 7 days of free access to the full post archives.