I remember after the pandemic filling my car and thinking there must be a mistake. I opened my heating bill and froze. The food shop felt as if it had doubled. Savings from the pandemic vanished in months. This was not a gentle rise in prices. It was a punch in the gut.

Inflation has eased since then, but you can still feel it. Prices are still rising, even if more slowly. It is hard to stop worrying. People fear it will come back strong, and they have a point. But now the US Federal Reserve has cut rates to support jobs, even though inflation is above target and core inflation is edging higher.

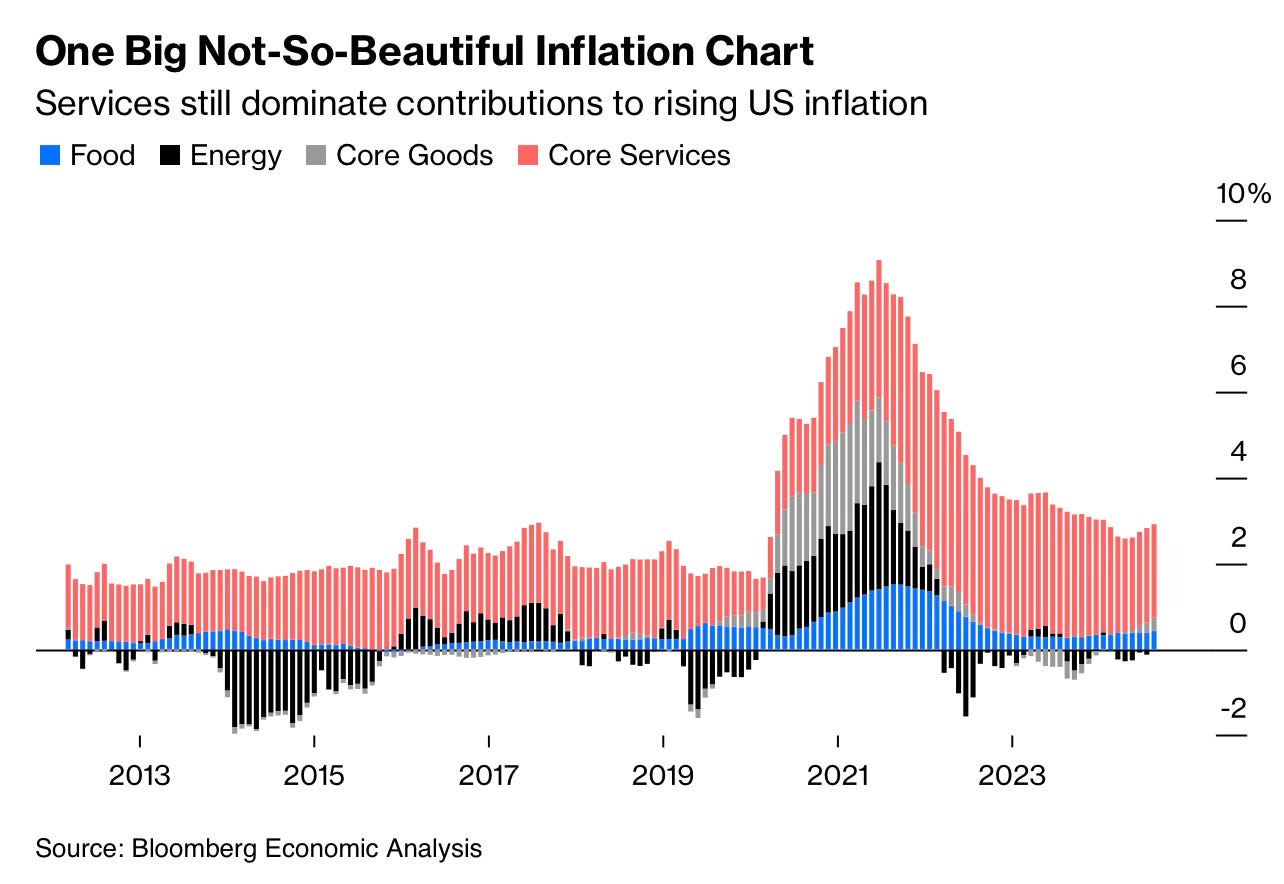

CHART 1 • Is inflation really still transitory?

This chart shows how US inflation has changed over the past decade. In the early 2010s energy swings were the main driver. Oil price collapses dragged inflation below zero at times, while rebounds pushed it higher. Food costs and goods played smaller roles.

That pattern flipped during the pandemic. From 2020 to 2022 shocks in energy, food and goods combined to create the sharpest spike in decades. Shipping costs surged, supply chains broke and energy prices roared back from their lows. The result was a broad based inflation shock that peaked at more than 9%.

What stands out today is what remains. Energy and goods inflation have eased, even turning negative at points, yet inflation has not gone away. The red bars, which represent core services, dominate the picture. Housing, healthcare, insurance and other service costs are proving sticky. This is why the Fed is uneasy. Even if supply chains heal and oil prices stabilise, services inflation is hard to shift quickly.

In other words, the inflation story has moved from temporary shocks to structural persistence. That is the issue we face today. Yikes.

Source: Bloomberg

It is hard to ignore inflation. It is still with us and it still bites. That is why there is real concern about the independence of the US Federal Reserve. Its mandate is price stability and maximum employment. Those goals can pull in different directions, especially now. Tariffs have unsettled companies and slowed hiring, while inflation has not fully cooled. Yet the Fed is cutting rates. Easing policy while prices remain sticky risks edging towards stagflation. Do you think the Fed is striking the right balance?

I have four more charts that dig into this. If you would like to see them, please consider becoming a paid subscriber if you are not already one.

Keep reading with a 7-day free trial

Subscribe to Killer Charts to keep reading this post and get 7 days of free access to the full post archives.