I couldn’t help but share this chart. I was in Florence a couple of weeks ago and the Renaissance architecture, the history and the art absolutely took my breath away. I have never visited such an extraordinary historic city. This was a the birthplace of the Renaissance and also home to one of the first reserve currencies. So forgive me, but I could not help but share this chart.

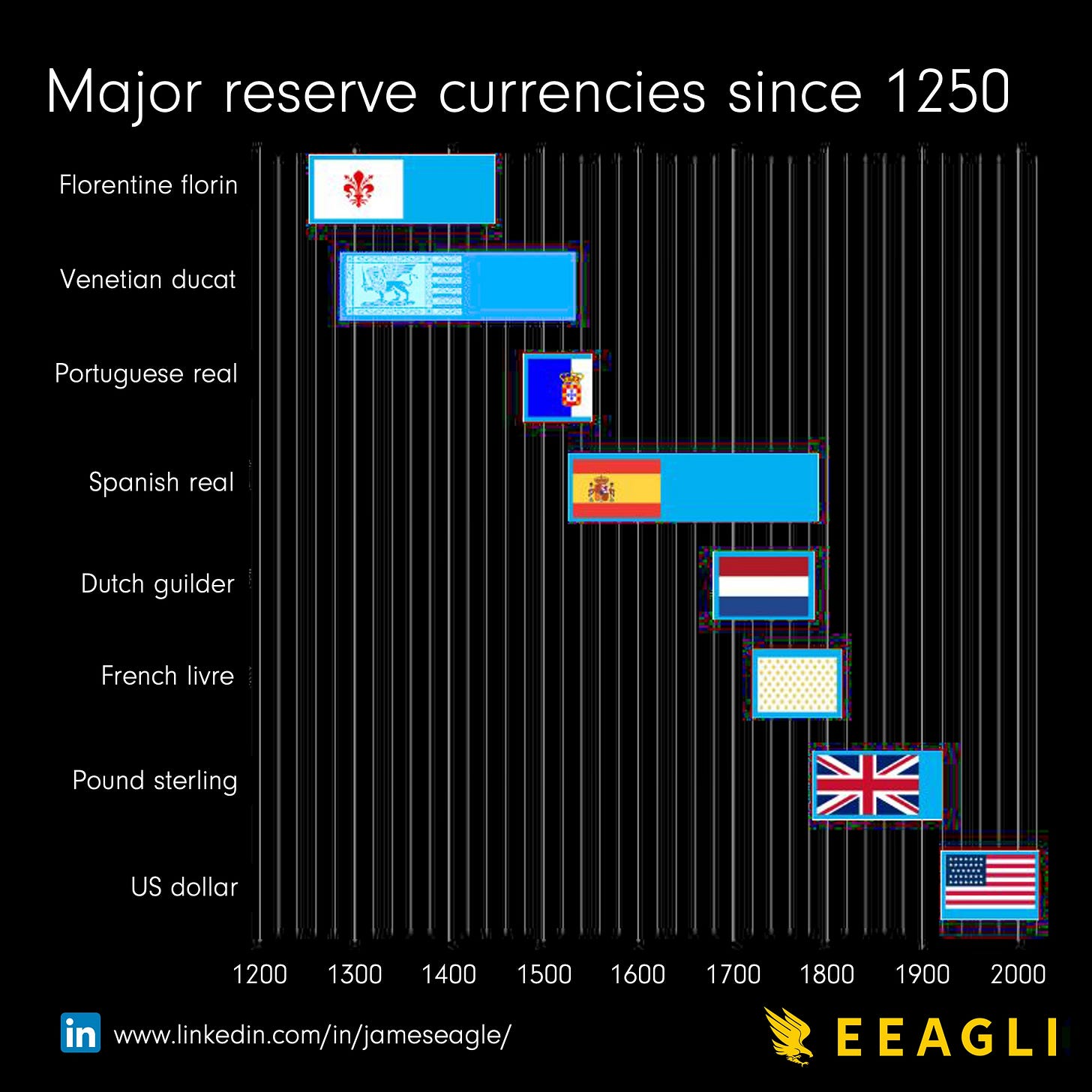

The chart starts in 1250 with Florence and shows how economic power has shifted around the world over time.

In the late Middle Ages, coins from Florence and Venice were widely used in international trade. As exploration grew, Portuguese and Spanish currencies became important due to their countries' overseas empires.

The Dutch guilder rose to prominence in the 17th century when the Netherlands became a major trading hub. This was followed by the French livre in the early 18th century, reflecting France's growing influence.

The British pound then took centre stage in the 19th century, backed by the vast British Empire. However, it lost ground after World War I and the Great Depression.

Since the mid-20th century, the US dollar has been the world's main reserve currency. This position was secured by the Bretton Woods agreement in 1944 and has continued due to the size and stability of the US economy. The question is what will happen next?

Source: Eeagli

Coming up:

How should we measure GDP?

Real estate is the biggest source of distressed bonds and loans globally

Foreclosures on US commercial real estate are on the rise

Top portfolio managers have delivered across time

If you like the sound of that line up, this is usually a paid newsletter. You basically get all my best ideas daily. Hit the subscribe button if you are interested and this will be sent to your inbox daily.

Keep reading with a 7-day free trial

Subscribe to Killer Charts to keep reading this post and get 7 days of free access to the full post archives.